When to Use a Contract for Deed

Contract for deed documents are utilized in a variety of situations, especially when traditional financing choices are not possible or preferred by either party.

Below are a few typical scenarios in which utilizing a contract for deed sample could prove advantageous:

- Credit obstacles: For buyers with low credit scores or limited credit history, getting a traditional home loan can be tough. A free contract for deed template allows them to negotiate directly with the seller, bypassing these hurdles.

- Flexible payment options: Sometimes, buyers and sellers prefer to negotiate terms that suit both sides, such as lower down payments, longer repayment periods, or customized interest rates.

- Unique properties: Certain properties, like fixer-uppers or unconventional homes, might not meet the strict standards of regular lenders. A free contract for deed form can be a good fit in these cases.

- Speed and simplicity: Sellers who want to expedite the sale can use a sample contract for deed, as it allows the deal to close faster without waiting for bank approvals, appraisals, or other typical closing steps.

- Investment opportunities: Investors looking to expand their portfolio can use a contract for deed to buy multiple properties without tying up significant capital in traditional bank loans.

Terms and Parties of the Contract for Deed

There’s the seller, who’s handing over the property, and the buyer, who’s looking to take it on. These two are the key players in the contract for deed example, each bringing their own interests to the table. The agreement details the key terms of the sale and typically includes:

- Purchase price: The entire sum that the buyer consents to pay for the property. It can be set at the market value or negotiated based on the property’s condition or other factors.

- Down payment: This term is the initial amount the buyer pays at the start of the contract. This payment is deducted from the total purchase price.

- Payment schedule: The contract specifies how much the payments will be and how often they need to be made (like monthly or quarterly). These payments usually cover both the principal and the interest.

- Interest rate: This is the percentage charged on the remaining balance. The interest rate is agreed upon by both the buyer and the seller.

- Transfer of ownership: Unlike regular sales, the seller keeps legal ownership of the property until the buyer has made all the payments. Once the buyer completes the payments, the ownership is transferred to them.

The agreement must clearly define what actions are considered a default (such as not making payments) and the ways in which the seller can respond, including the option to take back the property.

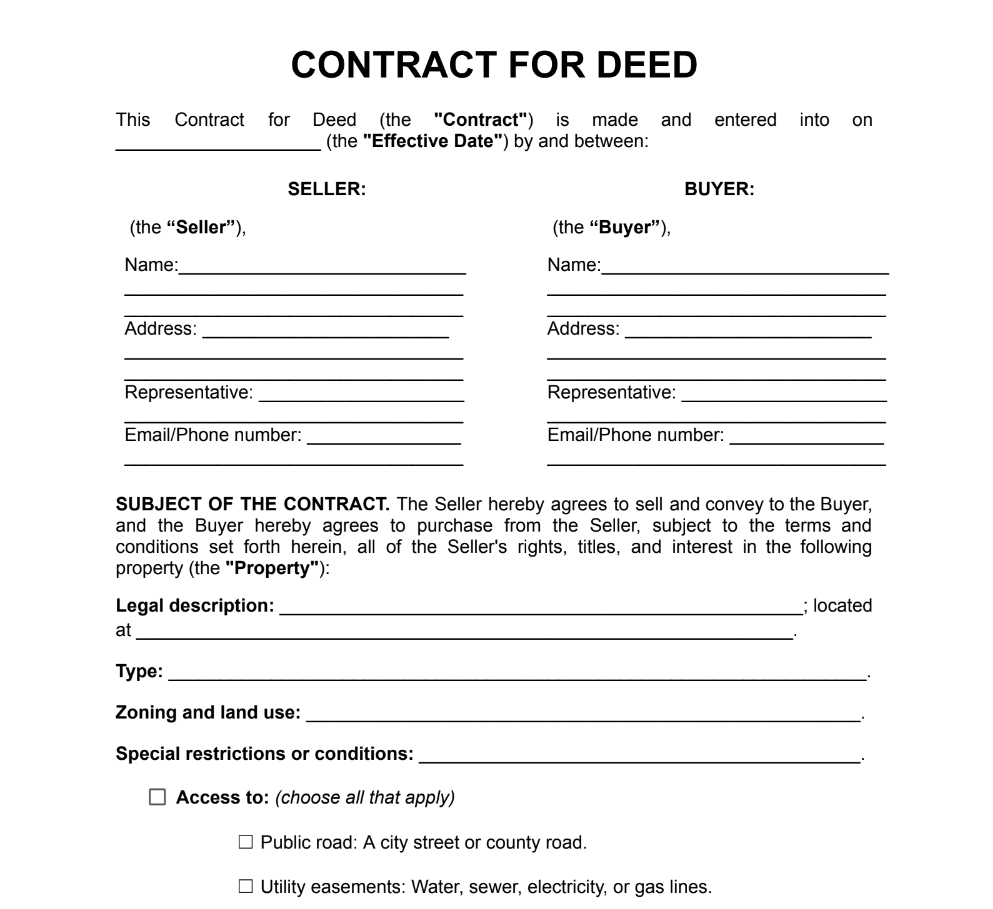

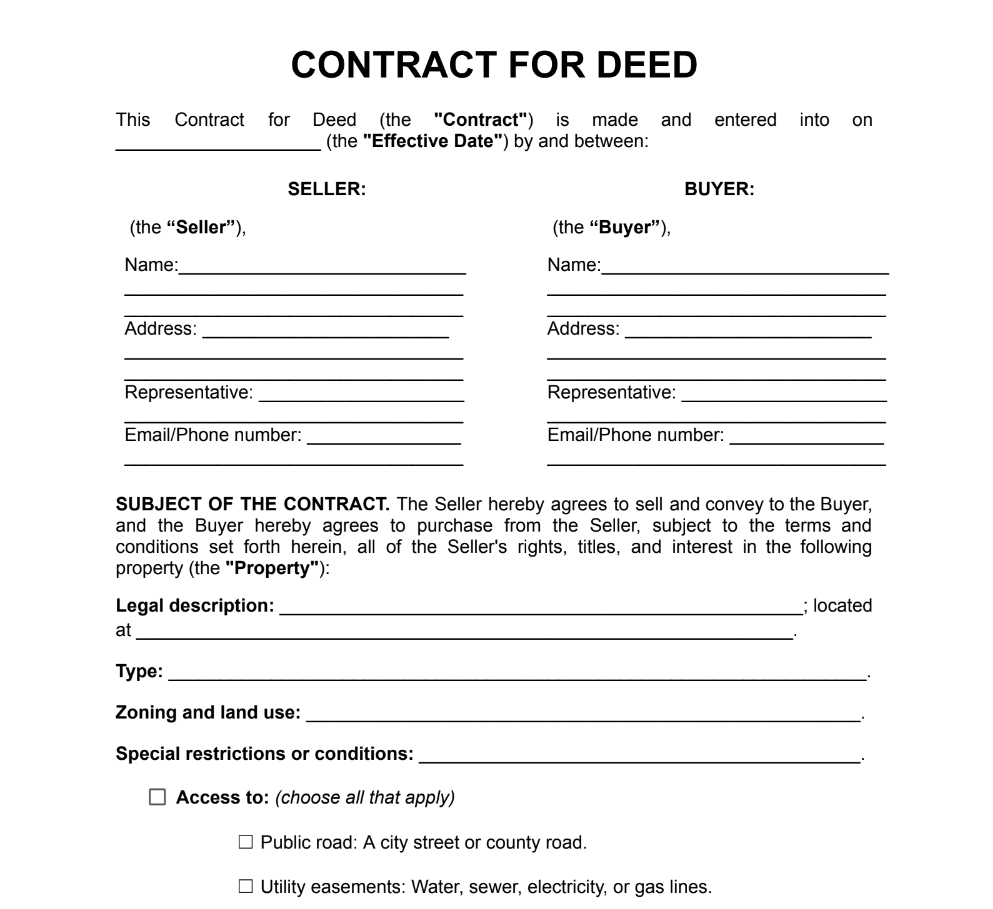

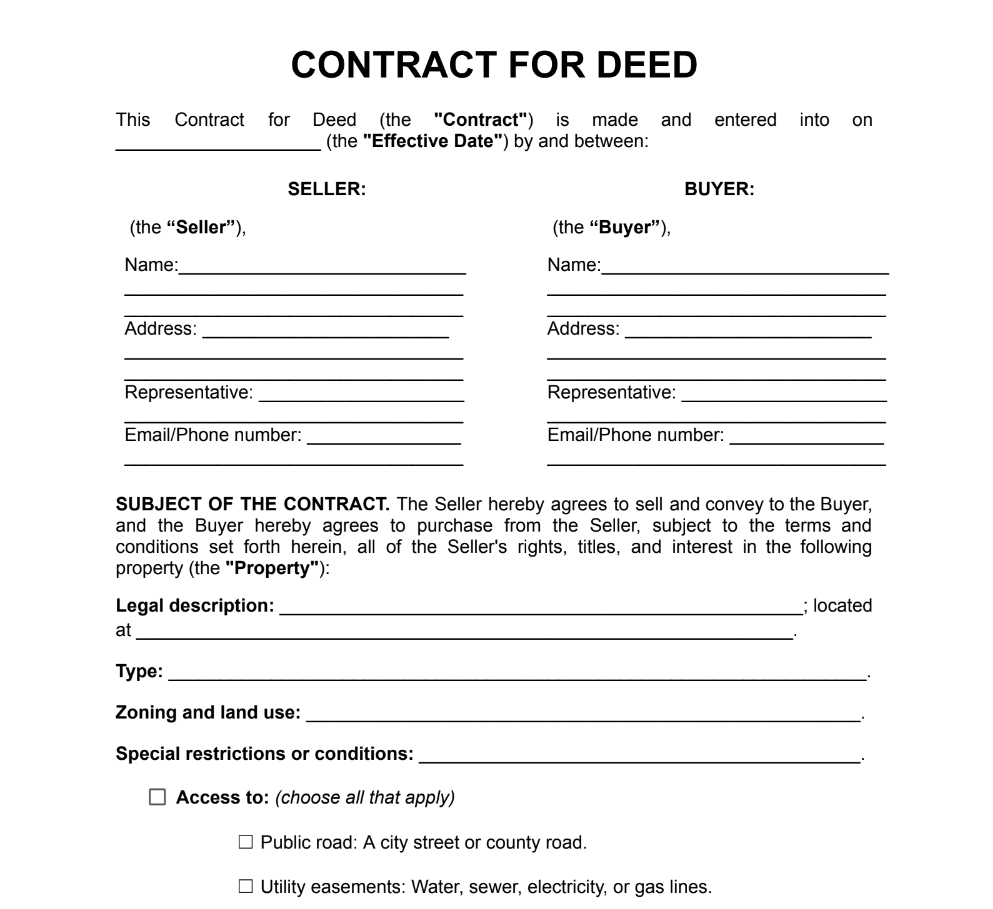

How to Create a Contract for Deed

Creating a contract for deed involves several key steps to ensure both parties are protected and understand their obligations. Here’s a step-by-step guide to drafting the document:

- Identify the parties: To prove the parties’ legal identities in the contract, including the seller’s and the buyer’s complete names, addresses, and phone numbers.

- Describe the property: Provide a full legal description of the property that matches what’s on the title deed, including any specific features or items that come with it.

- Outline the payment terms: Detail the purchase price, down payment, interest rate, payment schedule, and total number of payments. Specify how and to whom payments should be made, such as by check or direct deposit.

- Define default conditions and remedies: Clearly state what happens if the buyer doesn’t follow the agreement, such as late fees, grace periods, or steps for foreclosure or repossession.

- Detail responsibilities for taxes and insurance: Include a clause that explains who is responsible for paying property taxes and keeping insurance up to date to avoid any misunderstandings.

- Include a title retention clause: State that the seller will keep the legal title to the property until the buyer completes all payments, protecting the seller’s interests if the buyer defaults.

- Finalize and sign: Both parties should carefully review the contract and may consider having a lawyer review it. Once both agree, they should sign, date, and get the contract notarized to make it official.

Understanding the terms, knowing when and why to utilize the contract for deed forms, and carefully crafting their contract can enable both buyers and sellers to secure deals that benefit both sides of the transaction.

Consider using a free contract for deed PDF and Word format templates on Jurizmo to ensure all details are clearly defined. Also, you can seek professional guidance to navigate additional issues connected with this unique real estate transaction.

Preview

Preview

Preview

Preview